Navigating expat finance and the world of “International Financial Advisors” may appear daunting, but don’t worry, we are here to help.

International Financial advisors are the experts who guide you through global economic twists and turns and are there to hold your hand on your journey towards financial freedom.

Expat Financial Planning is crucial to your lifelong finance plan when you live overseas and hopefully, we can give you some financial tips for living overseas and help you choose the right expat financial services. Lets get going!

Understanding International Financial Advisors

International financial advisors are professionals skilled in guiding individuals through the difficulties of global finance.

They are your go-to when it comes to managing your financial affairs abroad offering investment strategies for expats by employing highly skilled international asset management skills.

The Importance of International Financial Advisors

Who are these international financial advisors and why do I need one?

If you are investment savvy, you know how to invest, you can pick the correct investments, you have a proven track record of successfully delivering positive returns year after year and you are capable of removing emotion from every decision that you make, then you may not need an advisor.

But for most people, this is not the case.

The aim of international financial advisors should be to help mitigate financial risk and optimise your assets overseas.

They should provide a layer of protection and ensure your financial decisions align with your goals.

Financial advisors are not investment gurus with magical powers. They are employed to use the best tools around them to the best of their ability and advise you on what they feel is the best way forward.

I am sorry to disappoint you, but there is no “silver bullet” that will make you millions overnight.

International financial advisors are there to build you a solid, robust structure that you fully understand.

The best description I have heard of a financial advisor is:

I couldn’t agree more with this statement. Hampton Bridge are constantly messaged by people that come to us with long-term plans layered with charges or who are heavily invested in single stocks or obscure alternative investments.

Hampton Bridge sees it as our duty to unravel these types of situations and put people back on track. Equally, we see it as our job to stop these situations from happening in the first place by investing in a broad range of assets in a well-diversified portfolio.

Services Offered by International Financial Advisors

Retirement Planning for Expats

Planning for the later years of your life is the cornerstone of nearly all financial planning and regardless of your nationality, your government-backed scheme will always fall short of an ideal retirement.

Many countries have agreements that allow you to contribute from overseas, however, expat pension planning is something you need to address.

Unless you have everything in place, then everybody needs to save on a regular basis towards their pension. Choosing the correct pension plan with the right terms, charges, flexibility and most importantly “affordability” is where you need a good financial adviser to guide you.

This is the “bread and butter” work for expat financial planners, but it must not be taken lightly.

Employ a healthy balance between your enjoyment today and your future goals. It is your international financial advisors’ job to install this ethos into you and not to over or under-commit you. You are employing the services of a professional to help you hit your goals in the most hassle-free manner.

Try calculating all of your monthly living expenses. With the money that is left over, your disposable income, commit 50-60% of this towards a structured savings account and with the remaining 40-50% put this in a liquid bank that you can access. If you do not need it then invest it at the end of the year.

Being recommended the right products for the right reasons with consistent, high-quality, ongoing attention should see you safely to your retirement.

Please read this here to see what all of your options are.

Children’s Education Planning

As a parent, ensuring your child’s tuition is often very near the top of your priority list and something you should discuss with your advisor.

The earlier you start investing, the more time your money has to grow.

Compound interest is a powerful tool that can significantly enhance the return on your investments over time. By investing in your child’s future, you’re not only safeguarding their future but also ensuring financial stability for yourself.

The first step to investing is creating a financial plan. This should include an estimation of future costs, accounting for inflation and rising fees.

The strategy behind University Planning is similar to Retirement Planning but over a shorter time scale with a smaller amount of capital needing to be grown.

All international financial advisors should be able to help structure you a plan tailored to your specific needs.

Please read this article to help you understand further about the costs involved.

Investment Management & Choice of Investments

When you have established your goals, you have found the correct advisor who works for a reputable company, this is where international financial advisors should start making investment recommendations.

International Financial Advisors should not be giving out advice on individual stock picking unless they are experts in this field, which is highly unlikely and a profession on its own.

The way you access the stock market is through mutual funds and ETFs.

Your investment portfolio should mainly consist of mutual funds and ETFs which will either try and track an index or beat it through active management. A good benchmark for an index is the S&P 500 which is an index that tracks the growth of the 500 largest companies traded on the American stock exchange…Google, Amazon etc.

Only 1% of mutual funds beat the index by more than 2% a year, so there is a very good argument to only invest in index funds. For many people, index investing is the preferred route, but there are mutual funds that consistently outperform the index. International financial advisor should be able to bring you examples of mutual funds that do this.

As a simple rule, do not invest in a fund with less than a 10-year track record, has less than $1 Billion under management and regularly fails to beat the S&P 500, FTSE, MSCI or DAX.

Approach Alternative Investments with absolute caution. Forestry, wine, whiskey, litigation the list goes on in this link which I implore you to click.

You can read about the risk of investing in alternative assets here.

Through strategic decisions, risk mitigation, and continuous adjustments, international financial advisors can guide you to achieve your financial objectives.

Expatriate Banking Solutions

As an expat, managing your money across borders can be a daunting task.

International banking, however, provides an effective way to augment your expat savings and forms a major foundation of overseas financial planning.

There are three major categories of international expatriate banks to consider:

Global Banks

Banks like HSBC and Citibank operate internationally and can help you manage your finances smoothly across borders. They employ experienced, qualified Cross-border financial advisors.

Keep in mind that when using big mega banks, you are just a very small fish in a very big pond.

Digital Banks

With the rise of technology, digital banks like Wise (Previously Trasferwise) or Currenxie have grown popular amongst the savvy expat community.

Wise is one of the fastest-growing online banks offering some of the cheapest rates and speed of transfer available. Banking and transfer fees form a crucial part of your financial planning for living abroad and your day-to-day living.

Local Banks

Depending on your destination, a local bank will offer significant benefits and better integration with the local economy. Ask on forums which banks are the best suited to foreigners, this is a very common question.

Please read here for more details.

If you would like to set up an account with Wise, which we strongly recommend then:

Click this link and as a reward Wise will allow you to transfer the first $550 completely free.

Real Estate

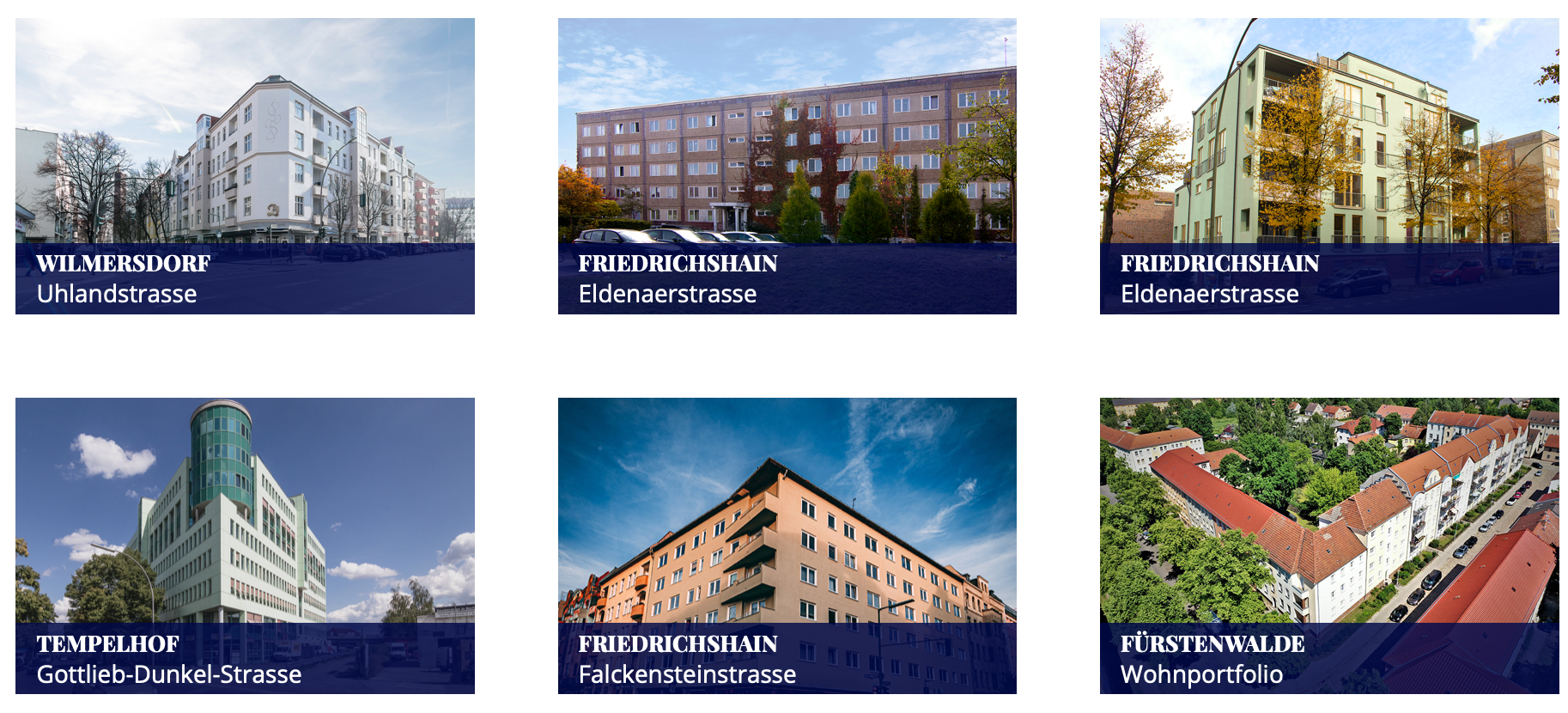

Real estate and overseas property is very complex and can be read about here

Insurance Planning for Expats

Choosing the right insurance is a crucial part of expat financial planning. I would advise you to go onto local forums on Facebook where you are living and get a broad view of what people are saying. EXPAT HEALTH INSURANCE IS EXPENSIVE, especially if you are a family of four, and the older you get the costs can spiral out of control. Always try and negotiate a good healthcare package for your family into your employment contract if possible. If you are retired, hired locally or have to look after yourself then I would advise you to follow some simple rules.

- Before purchasing a policy, find a good local clinic/surgery close to where you live. Speak to the doctor and find out what services he offers, does he speak good English, does the surgery operate in a clean, professional, friendly manner etc. Most of the time you need medical attention it will be for minor things like a rabies or typhoid jab or some stitches for one of your children falling off their bicycle or developing some kind of rash from the heat or something they have eaten. You do not need medical insurance for these kinds of procedures. Often you will be able to drive to the clinic in 5 minutes, be finished and back home in 30 minutes and all at a grand total of $20 or less.

- Once you have established point 1 then start looking for a policy that suits your family’s needs. You may find that even the most cost-effective policy will cover the above medical procedures, but your loading/excess charge on each claim, which can be a time and patience enduring process, may be as much as $100-$250. So even if you are insured for these services it is often far quicker and cheaper to use and pay for a local clinic to look after you. Medical insurance for many people is the “what if” insurance, car crashes, serious illness, repatriation, and overnight care, these are the types of services you will need comprehensive coverage for.

This can be a challenging subject, especially when dealing with multiple jurisdictions.

Work with international financial advisors who have experience in assisting expats with their needs.

They can help you evaluate the various policies that best suit your requirements.

Please contact us and we can help you!

Estate Planning for Expats

Estate planning is another critical aspect to consider as an expat.

By creating a comprehensive estate plan you can save your family from potential legal and financial hurdles, such as probate, after your passing, expat. tax advice can become extremely complicated.

Proper estate planning can require drafting a Will, Trusts & Power of Attorney. You must pay attention to all of the places you hold assets, where you are currently living and your nationality.

Some international financial advisors will not be in a qualified position to help you with this if your situation is complicated and you may need to speak to a specialist. This can be arranged by most international financial advisors.

Choosing the Right International Financial Advisor

It’s not just about having an advisor; it’s about having the right one. Look for professionals with solid experience and credentials. Ensure that they understand your financial goals and can provide sound advice.

Many expats are in search of the ideal offshore investment advisor as overseas financial planning may appear vastly different from domestic investing when considering factors like tax law, currency fluctuations, and international regulations.

International financial consultants should be able to assist you with Expat Tax Advice.

On the whole, the differences are small, limited and easily managed when approached correctly by professionals who are experienced in dealing with these challenges.

It is important to remember that your financial consultant is ‘the professional’. They need to clearly explain the advice, investments, products, risk and structures they are presenting.

Do not place too much judgement on the personality of the advisor but more focus on their skills, ethics, experience and track record. The best salespeople are always the most sociable, friendly and easy to get on with, but this doesn’t mean that the advice they are giving is the best, often it is the opposite.

Whereas some of the most astute and professional advisors I have met are at the other end of the scale. Do not forget that you are employing someone to do a very important job for you, this is not an exercise in making new friends.

Investment Management with International Financial Advisors

Your advisor of choice must employ a strict strategy that they lay out to you from the beginning.

Everyone has different needs and unique circumstances but at the end of the day everyone is looking for the same thing; someone they can trust who can look after and grow their wealth whilst offering adequate protection for their family in the process.

International financial advisors should have years of experience dealing with every kind of person and situation and they should have a process in place which they always stick to because they know it has worked in the past for all of their other clients.

FAQs about International Financial Advisors

Q: How do international financial advisors differ from a regular advisor?

A: International financial advisors specialise in global finance. They’re well-versed in international laws, regulations, and market trends.

Q: The need for international financial advisors?

A: They help you navigate the complexities of international finance, ensuring your financial decisions are informed, strategic, and beneficial.

Q: International financial advisors, how do I make the right choice?

A: Look for professionals with proven experience in international finance. Additionally, ensure they understand your financial goals and are capable of providing personalised advice.

In conclusion, if your financial needs span across borders, an international financial advisor is an invaluable asset. They offer guidance in navigating the global financial landscape, helping you make informed and advantageous decisions. Opt for an advisor who understands your goals and can provide bespoke advice to ensure your global financial health.