Embarking on the journey of overseas real estate investment can feel like navigating uncharted waters.

You might be lured by tales of high returns of buying a property abroad, a place to escape during vacations, or simply the charm of owning a piece of paradise in a foreign land.

But as a trusted advisor, I’m here to tell you that it’s not all sunshine and roses. Let’s explore the terrain of overseas real estate together and find out which countries offer the best opportunities.

Why Consider Investing in Overseas Real Estate

The first question that pops up might be, “Why should I even consider investing in overseas real estate?” There are several reasons you might want to do so. These can range from financial benefits to lifestyle upgrades or even as a step to becoming a global citizen.

The Process of Investing in Overseas Real Estate

Understanding the Market

Investing in overseas real estate is akin to learning a new language. You need to understand many facets, such as the nuances, trends, demand, and supply dynamics of the local market.

The better you understand the international real estate market, the better your chances of making a successful overseas property investment.

Put a lot of research into buying property abroad, go on local forums where you may wish to purchase and ask people for their advice and about their experiences. Ask them about the costs, tax implications, management services and ownership laws.

Getting Legal Advice

When investing in overseas real estate, overseas property laws and regulations play a significant role.

So, what’s the solution? Get yourself a good lawyer and real estate broker who is well-versed in the property laws of the country you are planning to invest in. Speak to people “who know how to invest in overseas real estate”

Financial Considerations

Understanding the financial implications, including tax laws, potential ROI, and property management costs, is critical.

The Mechanics of how it works – The Ups and Downs

Real estate is an excellent way to build your overall wealth whilst receiving an income in the process.

When living overseas, you will be approached by many property brokers in person, online or over social media. Their focus will be selling properties in the country where you are, but also in various other locations around the world.

The UK is always a popular choice for salespeople, as are various locations across Asia, such as Thailand and Malaysia and numerous other countries in Europe, highlighted below in the golden visa scheme.

Unless you are planning to live in your property, my advice would not be sucked into investing where you are living unless you feel very confident about the local market. The nation needs a distinguished and extended history of accommodating foreign investors, making it a leading destination for international real estate investments.

Example of Foreign Property Law – Thailand

For example, as a foreigner, you cannot own the land that your house is built on in Thailand. The land has to be 51% Thai-owned. There are now ways around this with experienced lawyers and shared ownership schemes where you can buy into a complex as part of a shareholder. I implore you to read this article to understand what you may be getting yourself into.

Thailand has strict laws on property ownership and defamation, so I will refrain from going into more detail. Here is another alarming story written in The Bangkok Post.

These cases are extreme, but they are not unique to Thailand and are unfortunately not uncommon in other countries as well.

Despite this article, we think Thailand is an excellent choice of country to invest in real estate. With all property investments, you must make sure you are dealing with the right people. These types of stories are not unique to Thailand.

Australia & New Zealand – Example

Numerous investors are exploring real estate in Australia and New Zealand, attracted by their reputation as secure and promising markets and as an ideal retirement location.

However, this surge in interest has resulted in inflated property prices. Real estate investors have shared their experiences of frequently competing against Asian investors at property auctions, who often bid above the market value.

Furthermore, developed economies are not free from scandal. After the financial crisis, we saw the collapse of Australian-based real estate investment company LM, which can be read about here. Many investors around the world lost money in the scheme.

Hampton Bridge doesn’t discourage investments in Australia and New Zealand. We view them, along with Thailand, as excellent investment options.

The key is to be mindful of potential risks and to position your investments strategically. However, the current market prices in these regions may be significantly higher than they should be.

Is Berlin The Answer

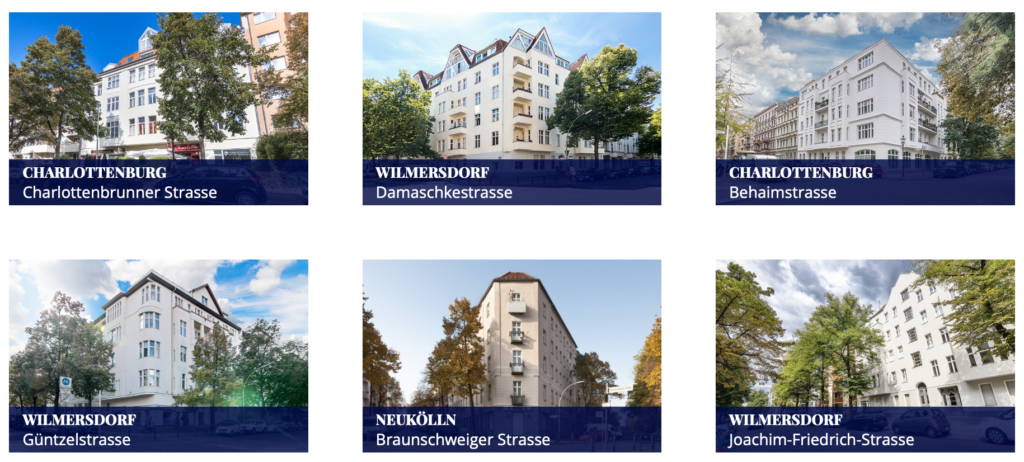

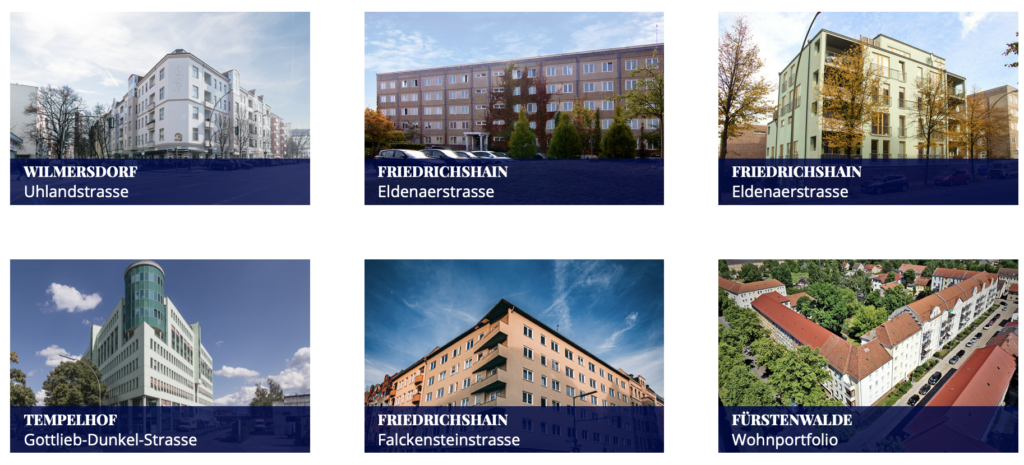

Hampton Bridge feels that out of all the destinations around the world for an overseas real estate investment, your best option is Berlin.

Prices are still very low compared to their European counterparts such as Paris, London, Munich or Milan, and Germany offers some of the strictest laws in the world to protect the tenants and owners of the property.

You can read more here about our latest project in July 2023.

Hampton Bridge/Inspiration Asia also encourage our clients to buy individual apartments in Berlin as the potential for growth continues to deliver double-digit returns every year across the city, and the market has been growing at this rate for over a decade.

Please contact us if you would like to learn more.

Tips for Successful Overseas Real Estate Investment

You must check all of your options and speak to various real estate agencies about international properties to get a good feel for what you think is right for you.

We cannot emphasise enough the importance of diversifying your investment portfolio. Real Estate Investments can provide a steady income stream through rental yields and appreciation in property value.

However, real estate can be capital-intensive. Therefore, we recommend conducting thorough market research.

Key things to look for in a location when buying a property: Strong, growing economy, regular flow of immigration into the city, undervalued market with potential for growth and high employment. All of these are your key indicators when investing in overseas real estate.

Be patient and diligent in your research. Understand the local culture and regulations, work with reliable professionals.

It might seem like a lot of work, but remember, the journey of a thousand miles begins with a single step!

Golden Visa Scheme

Many European countries have been offering “Golden Visa” schemes to Asian investors over the last ten years, which offers the investors a lifelong visa to the country where they invest.

You can read more about this here.

These schemes are aimed towards the Asian market, as people from Asia often have difficulty travelling and living in Europe due to visa requirements. They can also access first-rate healthcare and education, which can be far more expensive in Asia.

Conclusion

Investing in overseas real estate is not as daunting as it appears you are simply just buying a property. It does come with its own set of challenges and risks. But with due diligence, it can offer attractive benefits. So, as an expat investor, are you ready to explore this journey and make the world your oyster?

Frequently Asked Questions (FAQs)

Is investing in overseas real estate a good idea?

It depends on your financial goals, risk tolerance, and understanding of the foreign market. It can offer high returns and diversification, but it also comes with risks.

What are some popular countries for overseas real estate investments?

Countries like Spain, Portugal, Thailand, and the Dominican Republic are popular among investors due to favourable real estate laws and the potential for high returns.

How can I manage my property if it’s overseas?

You can hire a local property management company to handle maintenance, rent collection, and tenant-related issues.

What are the legal considerations for investing in overseas real estate?

Legal considerations can vary by country and may include property ownership laws, tax implications, and contractual obligations.

Can I live in my overseas investment property?

Yes, you can use your property as a vacation home or even apply for residency, depending on the country’s laws.