The Dawn of Index Funds

In the effervescent landscape of investments, index funds stand as towering monoliths. We will discuss the simplicity and the complexity, which constitutes index funds.

How you can strategically employ them to amplify your financial portfolio. At the end of this extensive exposé, you’ll master the art of wise passive investing.

The Genesis of Index Funds

In 1975, the vanguard of investment strategies emerged – the Index Fund. This ingenious invention was the brainchild of John C. Bogle, who founded the Vanguard Group. Today, Vanguard manages a whopping $8.1 Trillion.

The motive behind this innovation was to furnish investors with a reliable and low-cost avenue for attaining market averages by “Index Fund Investing”.

Essentially, they are mutual funds or ETFs that mirror the performance of a market index, such as the S&P 500. Read here if you would like to learn more about ETFs vs Mutual Funds.

S&P 500 Index Fund – SPDR Low-Cost Investing

The S&P 500 is an index sponsored by Standard & Poor’s, which is one of the largest global financial ratings agencies. The index tracks the 500 largest companies traded on the American Stock Exchange. Companies such as Amazon, Microsoft, Exxon and Apple.

You can read more about it here through the SPDR blog.

A stock index is a measurement of a section of the stock market, calculated from the prices of selected stocks. It provides a snapshot of how these stocks are performing and serves as a benchmark for investors to compare the returns on specific investments, such as Index and Mutual Funds.

Index fund investing is an excellent choice for investors with a long-term horizon. It is perfect for retirement planning as it offers broad asset allocation and portfolio diversification.

Index investing can also be broken down into sector index funds, like Bond Index Funds, international Index Funds, Stock Index Funds, Real Estate Index Funds….or ETs.

The Mechanics of Index Funds: Index Funds for Beginners

What are Index Funds?

They are an assortment of stocks, bonds, or other assets. Unlike actively managed funds, it’s not subject to the whims of fund managers. Active vs Passive Investing is a very common discussion in the investment community.

The benefits are that they are inherently diverse and mitigate risks by spreading investments across multiple sectors. They are what is commonly known as a “passive investment”.

The Economic Wizardry

One of the pivotal aspects is their fee structure. Owing to their passive nature, the expense ratios are considerably lower than their actively managed counterparts, resulting in Low-Cost Investing.

How to Invest in Index Funds

Most pensions, savings plans, SIP Investment (Systematic Investment Plan) and regular investment plans will give you broad range access, you can read more about them here.

Trading through a Lump Sum investment is very easy as investment platforms or portfolio bonds are set up to facilitate Index Investment. You can read about Lump Sum investing here.

If you invest offshore, you can benefit from how tax-efficient index funds are.

Active vs Passive Investing

Diversification in Index Funds

Ascertaining your investment goals is paramount as these funds are versatile and can cater to an assortment of objectives, be it retirement, wealth creation, or building an emergency fund.

The true beauty of certain funds is that you can leave them unmanaged and not worry about them.

Active management is when you buy an investment like a mutual fund that has a fund manager who employs a team of analysts to buy and sell stocks and shares on an hourly basis to beat the Index.

This comes at a cost compared to Low-Cost Index fund investing, so carefully compare the historical results, expense ratio, asset allocation and what diversification is best for your portfolio.

Selection Savvy

Not all funds are created equal. Assess the performance history, expense ratios, and the underlying index. Ensure that the fund aligns with your investment goals and risk tolerance.

At Hampton Bridge, we use a wide variety of investments that cater to all of our client’s needs.

Diversification – Can I get a Dividend Yield in Index Funds?

Don’t hoard all your eggs in one basket.

Diversification in Index funds is the linchpin in mitigating risk. Opt for funds that span different industries, geographic locations, and asset classes. Some will also pay you a dividend that may be re-invested or be used as an income through retirement.

Many clients approach us want to invest in sectors such as new energy or a country such as China. Often, they do not know which fund or stock to buy or whether wind or solar is the future.

We advise them to hold a “New Energy” or “China” index fund that tracks companies across the entire sector or country.

The Art of Patience

This style of investment is not a ticket to instant riches. It is best suited for a long-term investment strategy.

Exhibit patience and allow your investments to compound over time.

“Compound interest is the greatest force in the universe” Albert Einstein

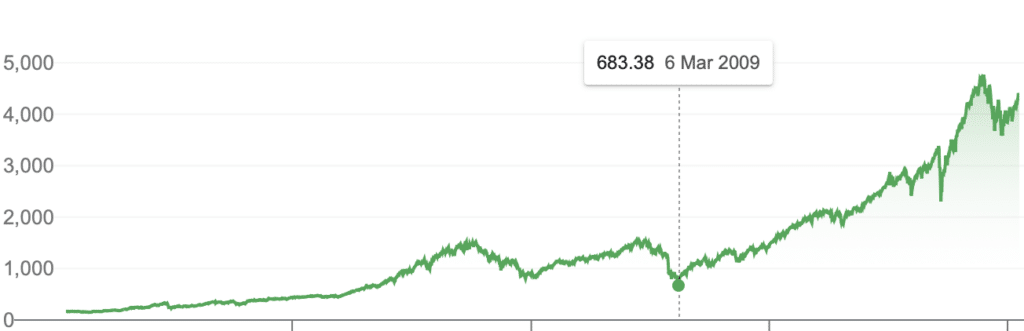

On the 6th of March 2009, a low point, the S&P was valued at 683. Today, 29th June 2023, 14 years later, the S&P is valued at 4376. The potential net gain over a 15-year time horizon is mouthwatering for investors who do not like risk.

Navigating Potential Pitfalls

Fee Awareness

Though this strategy typically has lower fees, it’s imperative to remain vigilant. Evaluate the expense ratios and steer clear of funds that levy extraneous charges. But don’t substitute quality over cost.

Market Volatility

Like any investment, be aware of market fluctuations. Establish a robust financial cushion and refrain from panic selling during market downturns.

The job of an advisor is to stop clients from making mistakes with their money. One of the most common mistakes within the finance industry is investors selling quality funds due to uncontrollable, natural economic circumstances.

The Road Ahead – The Future of Index Funds

With the evolving financial world, we see a strong foundation for future success.

Innovations in financial technology and an ever-increasing globalised market signify that this investment style is poised to remain a pillar in investment portfolios.

Transforming Knowledge into Wealth

Index funds are a trusted investment choice and something we wholeheartedly believe in at Hampton Bridge.

Frequently Asked Question (FAQs)

What is an Index Fund?

Index funds are a type of mutual fund or ETF designed to replicate the performance of a specific market index, like the S&P 500. They aim to provide broad market exposure, low operating expenses, and low portfolio turnover.

How do Index Funds Differ from Other Mutual Funds?

Unlike actively managed mutual funds, index funds follow a passive investment strategy, aiming to match rather than beat the market. This typically results in lower fees and a more predictable performance pattern based on the index they track.

Why Choose Index Funds for Investment?

Index funds are often recommended for their diversification, lower costs, and historically consistent returns. They are suitable for investors seeking a long-term, passive investment strategy.

What are the Risks Associated with Index Funds?

While generally less risky than actively managed funds, index funds are subject to market risk. If the underlying index performs poorly, the fund will mirror that performance.

Can Index Funds Be Part of a Retirement Plan?

Absolutely! Index funds are commonly included in retirement portfolios due to their lower fees and diversification, making them a wise choice for long-term growth.

How Do I Choose the Right Index Fund?

Consider factors like the fund’s track record, expense ratio, the index it tracks, and your own investment goals. Consulting with a financial advisor can also be beneficial in making an informed decision.

Are Index Funds Tax-Efficient?

Yes, generally. Index funds tend to have lower capital gains distributions due to their passive management style, making them more tax-efficient compared to actively managed funds.