We understand that as an expat, safeguarding your savings is paramount.

In this comprehensive guide, we will unveil the Top 5 Expat Savings Options that can secure your financial future.

We will dive into the nitty-gritty details about expat savings accounts, expat retirement options, risk factors and expat financial security to equip you with all the knowledge you need. Let’s jump in!

1. Understanding Expat Savings Options: The First Step

International Savings Account

One of the first steps we recommend is to set up an International Savings Account. These accounts often come with a variety of international fund options, which is perfect for expats.

Look for accounts with low fees and favourable interest rates. Popular options include HSBC Expat and Investors Trust S&P 500.

The S&P 500 plan administered by “Investors Trust” is attractive to international investors due to its low fees and capital guarantee facility set at 140% of your contributions.

This plan is excellent for expatriate wealth preservation and should be a part of all expat financial planning.

This is a popular expat savings savings option amongst our clients at Hampton Bridge. It is an excellent way of saving money while living abroad.

An account like this will help you hit your expat financial goals whilst giving you a guaranteed return on investment.

Expatriate money management and expat savings options can appear to be a little complicated at times.

Our advice is to keep things simple and track indices by using index funds or ETFs, and if you have a product that offers a guaranteed return on investment, then this should be considered a good expat savings option.

Expat Money-Saving Tips: Look for jurisdictions with rigid investor protection laws. Hong Kong, Malaysia and Singapore are often cited as excellent options for expats.

Caution: No single fund family has the best funds across all the asset classes. If you buy an HSBC investment account and it comprises just HSBC funds, then you are missing out on higher-performing funds offered by other expat banking solutions.

Index investing is now becoming the savvy investor’s choice as an expat savings option, despite there still being hundreds of excellent mutual fund options with a strong history to choose from.

2. Portfolio Bonds/Investment Platform Expat savings options

A Portfolio Bond might be the flexible friend you need. It’s an insurance bond that allows the holder to invest in a plethora of assets, including mutual funds, stocks, and bonds.

Why is this beneficial for expats?

Well, the main advantage is the tax-efficient growth. We are all looking for tax-efficient expat savings, and a Portfolio Bond proves itself to do the job as well as any other investment. As it is considered “life insurance”, it is taxed more favourably than standard investment accounts.

In many jurisdictions, the investment grows tax-free, allowing your wealth to compound over time.

Here is an example of an Investment Platform that Hampton Bridge provide.

This Bond, or platform is known as “Open Architecture”, meaning that you can hold any form of investment within it.

With your expat savings options, you should be investing in a broad range of ETFs and Mutual Funds and something uncorrelated to the market, such as a Hedge or Futures Fund.

Expat Money-Savins-Tip: Look for Bonds that offer a limitless investment choice with high-yield savings for expats.

Caution: The bond is just an investment account, or wrapper that is empty when purchased. The choice of the expat investment opportunities that are put inside it will determine your success.

Here is an excellent fund by Veritas. This is their Global Focus Fund.

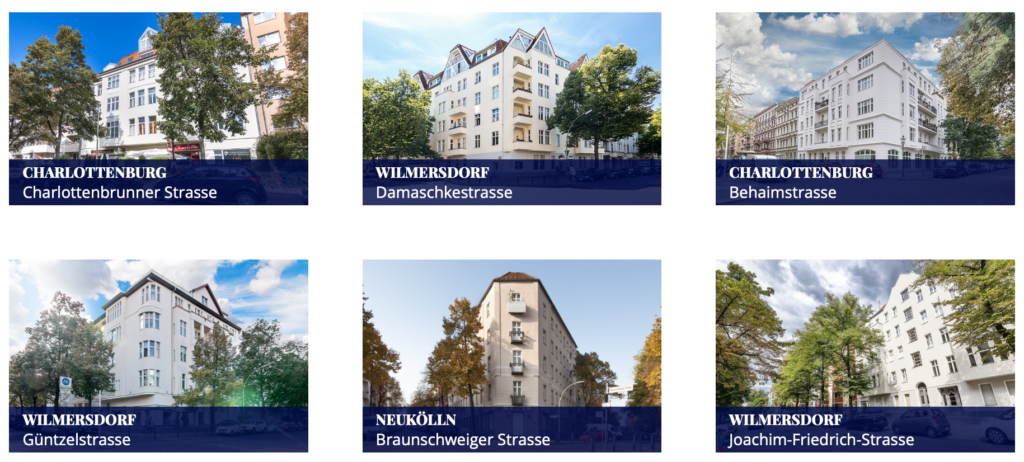

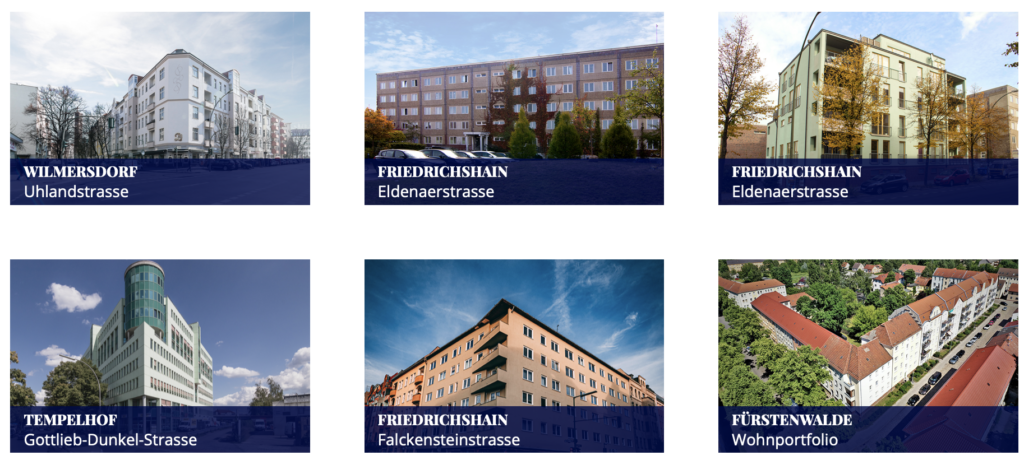

3. Real Estate Investments: Building Assets with Tangibility

We cannot emphasise enough the importance of diversifying your investment portfolio.

Real Estate Investments can provide a steady income stream through rental yields. Over time, the property should appreciate, thus making it an excellent choice as one of your expat savings options.

However, real estate can be capital-intensive. Therefore, we recommend conducting thorough market research. Key things to look for in a location when buying a property: Strong, growing economy, regular flow of immigration into the city, undervalued market with potential for growth and high employment.

Expat Money-saving tips: Berlin and Lisbon are often cited as the cities that offer the best value and tick all the right boxes.

If you would like to explore options in Berlin, then click here.

Caution: DO NOT buy an off-plan property which “guarantees” a rental income. So many buildings fail to get completed by running out of money halfway through, resulting in the early investors losing all of their money. This is certainly not one of your best expat savings options.

4. Crypto Currency: A very high-risk/reward strategy

Many investors are now looking for new hi-tech expat savings strategies, and investment options such as Crypto have entered the market.

This is something we urge all investors to approach with caution. The potential gains have proven to be astronomical, but the losses can be shattering.

Bitcoin is regarded as the “Gold Standard” of crypto, so if this does interest you, check the price of Bitcoin each day to monitor its price movement.

Pro tip: Seek advice from a financial advisor who knows about Crypto. It is one of the highest-risk and most complicated investment spaces.

Caution: Do not listen to people on YouTube who say you will become a millionaire overnight.

Read here about the many ways you can invest in Crypto without actually having to hold the physical asset.

5. Pension Transfers to QROPS: Taking Control of Your Retirement

Finally, transferring your pension to a Qualifying Recognised Overseas Pension Scheme (QROPS) can be a game-changer. It allows expats to consolidate pensions into one pot.

This is not only efficient, with a broad investment choice, but it can also offer significant tax benefits, making it a crucial part of expat savings options for retired Brits or people who have worked in the UK.

Pro tip: Speak to a pensions specialist who can advise on the complexities and regulations surrounding QROPS.

Caution: Although a QROPS is an excellent expat investment tool, it is only appropriate for certain pensions. Speak with advisors who are knowledgeable in this field.

Please feel free to contact us.

Frequently Asked Questions (FAQs)

What are the top expat savings options available?

The top expat savings options include International Savings Accounts, Portfolio Bonds/Investment Platforms, Real Estate Investments, Cryptocurrency Investments, and Pension Transfers to QROPS. Each of these options offers unique benefits and suits different investment needs and risk tolerances.

Why are International Savings Accounts recommended for expats?

International Savings Accounts are ideal for expats due to their flexibility, variety of international fund options, and potential for lower fees and favorable interest rates. They are suitable for expats seeking wealth preservation and a guaranteed return on investment.

What is a Portfolio Bond and why is it beneficial for expats?

A Portfolio Bond is an insurance bond that allows investing in a wide array of assets like mutual funds, stocks, and bonds. Its main advantage for expats is tax-efficient growth, as the investment often grows tax-free in many jurisdictions, allowing for wealth compounding over time.

How can Real Estate Investments benefit expats?

Real estate investments offer expats a tangible asset that can provide a steady income through rental yields and potential property appreciation. However, they require substantial capital and thorough market research to identify locations with strong economies and growth potential.

What should expats consider before investing in Cryptocurrency?

Cryptocurrency investments are high-risk/high-reward and require caution. Expats interested in this option should seek advice from knowledgeable financial advisors and avoid sensational claims of quick wealth. Monitoring the market, especially the movement of Bitcoin, is essential.

What are QROPS and how do they assist expats with pension management?

QROPS (Qualifying Recognised Overseas Pension Scheme) allow expats, especially those from the UK, to consolidate their pensions into one pot, offering efficiency, a broad investment choice, and potential tax benefits. However, it’s crucial to consult with a pensions specialist to understand the complexities and regulations.

What are the key factors expats should consider when choosing a savings option?

Expats should consider factors like tax efficiency, risk level, investment flexibility, jurisdictional investor protection laws, and long-term financial goals. It’s also important to balance high-risk options like cryptocurrency with more stable investments for a diversified portfolio.

Conclusion: Empower Your Expat Savings Options

There you have it – the Top 5 Expat Savings Options that can anchor your financial future. Each option comes with its own set of benefits and risks. We believe that knowledge is power. Equip yourself with financial wisdom, and may your expat journey be prosperous and fulfilling.