When living abroad, scoping out the investment arena can be tricky for the amateur investor.

Fortunately, FTSE 100 ETFs are an excellent vehicle for those looking to unlock the door to investing in the UK’s top companies.

Let’s look deeper into this investment opportunity and find out why there is over £2 Trillion invested in the FTSE 100 index.

What is a FTSE 100 ETF?

For expats unfamiliar with the jargon, an ETF stands for “Exchange Traded Fund”.

FTSE 100 ETFs track the performance of the 100 largest publicly traded companies on the London Stock Exchange. Companies like HSBC, Shell and Barclays.

This means that by investing in this ETF, you are directly allocating your money to these top companies, offering a nice slice of the UK’s financial market to your investment portfolio.

Who doesn’t like a nice slice of the pie?

What are the Best FTSE 100 ETFs?

When choosing your best options, it’s essential to consider critical factors such as management fees, liquidity, and tracking accuracy.

Here are three very good ETFs that you can invest in that all do the job perfectly well:

Each offers its own unique set of benefits by offering their investors a slightly different way of having exposure to the UK market. I am happy to recommend any of these ETFs to any investor of any experience.

How to Invest in the FTSE 100

Dipping your toes into “The world of ETFs” might seem daunting, but it’s relatively straightforward. First of all, open up a brokerage account that allows you to trade international ETFs.

Once set up, it’s as easy as buying shares in a company. ETFs are traded in the same way as stocks and shares, so they are simple and easy to buy and sell.

Go here for advice on how to open a brokerage account.

Benefits of Diversification and Asset Allocation with FTSE 100 ETF

The beauty of the FTSE 100 ETF lies in its broad diversification across all of the UK’s largest companies.

Instead of placing all your eggs in one basket by investing in a single company, the ETF spreads your risk across the UK’s top businesses.

This broad exposure reduces the impact if one company underperforms. This is why single-stock investing is difficult, risky and unnecessary!

FTSE 100 vs S&P 500 ETF

While both are two of the largest indices in the world, the FTSE 100 represents the UK market, while the S&P 500 gives you exposure to the US market.

(If you want to invest in the S&P 500 then you can learn more here.)

Regardless of where you are residing as an expat or where you foresee future financial interests, consider the benefits of both investments as viable options for your portfolio.

Both offer diversification, but they represent different economies and market dynamics. Remember, diversity is your friend.

FTSE 100 ETF Performance

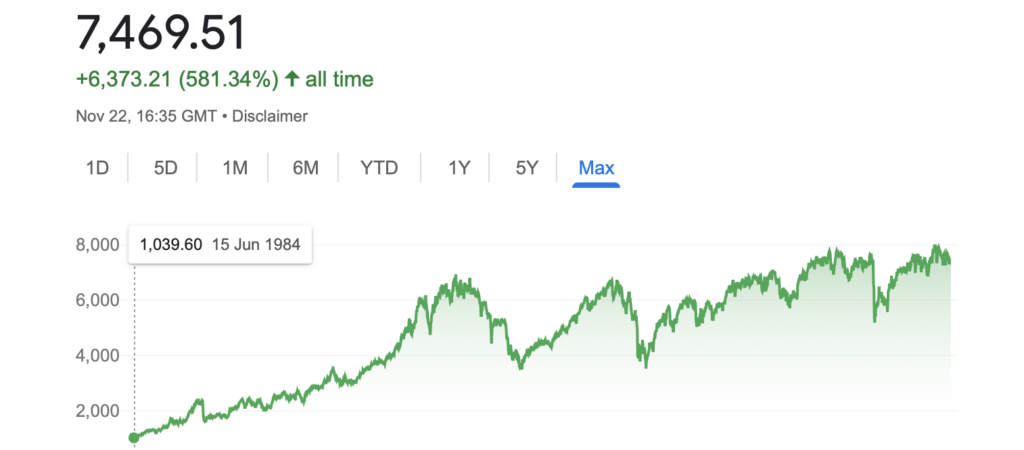

Over the years, FTSE 100 ETFs have shown resilience, bouncing back from market downturns and offering steady growth.

As you can see from the graph below, there is always an upward trend. The FTSE 100 is slightly volatile, which would make it a perfect investment for someone who wants to invest on a monthly basis to take advantage of “Unit Cost Averaging”.

Like all investments, past performance isn’t indicative of future performance. (We have to write this, but most of the time, past performance is an indicator of future results over the medium to long term)

Regular performance and strategy reviews are necessary when investing in ETFs.

The Low-Cost Advantage of ETFs

Fees are a pivotal factor in investment gains.

Fortunately, ETFs nearly always have far lower expense ratios than mutual funds. Sometimes as low as 0.25% annual management fee!!!

That’s value for such a good investment.

The effect that this can have on the impact of your investment returns can be phenomenal. Never underestimate the power of compound interest. As Albert Einstein said:

“It is the 8th wonder of the world“

Flexibility of Trading with ETFs

Unlike mutual funds, which have a set trading time of once a day. ETFs trade like stocks, minute by minute, second by second.

This means you can buy and sell through the trading day, offering flexibility that mutual funds often can’t match.

FTSE 100 ETF Dividends

Many companies within the FTSE 100 index pay their investors dividends.

By investing in these ETFs, you typically receive these dividends proportionally, which can be a source of passive income. You can have them reinvested to grow your investment further.

Historical Data of the FTSE 100

Reviewing historical data can provide insights into how the ETF has performed over the years. While past performance doesn’t guarantee future results, understanding trends can help guide your decision-making.

Risks of FTSE 100 ETF

Every investment carries risk.

Factors such as global economic downturns, shifts in the UK’s political landscape, and changes in currency value can impact the FTSE 100 ETF’s performance, something that has happened a lot post-Brexit.

Diversification within the ETF does help mitigate a lot of the risks, but it’s vital to be aware and consider your risk tolerance.

FTSE 100 ETFs for Beginners

For expats new to investing, FTSE 100 ETFs offer a simple, straightforward way to gain exposure to a wide range of companies, giving you a good variety of asset allocations for a fully diversified portfolio. These are the key markers you are looking for as an investor which help you protect your money whilst you watch it grow.

Their diversified nature, combined with the potential for dividends and capital growth, makes FTSE 100 ETFs an attractive choice for those starting their investment journey.

Conclusion

Investing abroad can appear to be a complex endeavour, but it doesn’t need to be.

With tools like a FTSE 100 ETF, expatriates have a solid go-to option at their fingertips.

FTSE 100 ETF investments provide an avenue to invest in the UK’s top companies, offering diversification, growth potential, and a degree of flexibility that’s hard to beat.

Frequently Asked Questions (FAQs)

How do I start investing in the FTSE 100 ETF?

Start by opening a brokerage account that accommodates international trading. Then, you can buy shares in an FTSE 100 ETF as you would with any other stock.

What is the difference between FTSE 100 ETF and mutual funds?

ETFs trade like stocks, offering flexibility throughout the trading day. Mutual funds trade once a day. Moreover, ETFs often have lower expense ratios than mutual funds and usually don’t have a manager.

Can I receive dividends from the FTSE 100 ETF?

Yes, many companies within the FTSE 100 index pay dividends. By investing in the ETF, you usually receive these dividends proportionally.

Are FTSE 100 ETFs safe?

All investments carry risks. While the FTSE 100 ETFs offer diversification across the UK’s top companies, it’s still susceptible to economic, political, and currency shifts. Always assess your risk tolerance before investing. Despite this, it is regarded as 5/10 on a risk tolerance scale.