Stepping into the world of offshore wealth management can appear alluring to the newcomer and even the most experienced investor.

So, what exactly is offshore wealth management? It’s a strategy for expats to grow, protect, and manage their wealth using foreign financial institutions, investments, and legal structures.

Why Offshore Wealth Management?

Why do many expats turn to offshore wealth management? On the whole, it is a great route for tax efficiency, asset protection, growth, flexibility and increased confidentiality.

Offshore wealth management offers the overseas investor a whole new world of global investment opportunities that are not available to people living in their home country.

Types of Offshore Accounts

Primarily, there are three types of accounts: savings accounts, checking accounts, and investment accounts, which all cater to your offshore wealth management needs.

Each type serves its unique purpose, from basic banking transactions to securing a nest egg for the future. These accounts are very similar to their counterparts back in your home country but are located in global tax havens.

1. Channel Funds into the S&P 500 via an International Savings Account

Consider a journey into the global market!

It’s a good idea to initiate with an International Savings Account. Choose an account that offers an expansive range of global fund selections, prominently featuring the S&P 500.

Prioritise accounts that promise low-fees. If you can get a “capital guarantee”, then this is good news!

Renowned options in this space are Investors Trust S&P 500.

“Investors Trust” offers an S&P 500 scheme that has garnered significant attention from global investors, primarily due to its reasonable fee structure and impressive 140% capital protection over 15 years.

This strategy stands out as a formidable choice for conserving the assets of expatriates and undeniably should be a cornerstone in expatriate financial planning.

Many of our clients at Hampton Bridge favour this approach as their go-to expatriate savings tool, identifying it as an invaluable method for financial growth overseas.

Such accounts pave the way to realise your overseas financial aspirations, assuring an excellent return on investment.

Our guiding principle? Maintain clarity. Focus on investments that cater to market indices, like index funds or ETFs.

If there’s an opportunity guaranteeing investment returns, it’s worth exploring as an option for your expatriate savings.

2. Direct Investments towards the S&P 500: Through Portfolio Bonds/Investment Platforms

Are you aware of the offshore investor’s “Personalised Portfolio Bond?”

This kind of insurance bond is an adaptable ally in your financial toolkit. It allows for diverse financial placements across a whole array of assets – mutual funds, equities, or bonds, all circling back to the S&P 500.

So, what’s the advantage for an expatriate?

The standout benefit is the capacity for tax-free growth. An overarching goal for expatriates is to identify tax-savvy saving investments.

As an illustrative example, Hampton Bridge rolled out two investment platforms:

1. Access Portfolio – Really cost-effective, flexible, and you can hold any asset.

2. Ardan International – 100% flexibility and draw down at a day’s notice, low fees and unlimited investment choice.

Labelled as “Open Architecture”, these Bonds or Platforms are designed to accommodate a vast spectrum of investments.

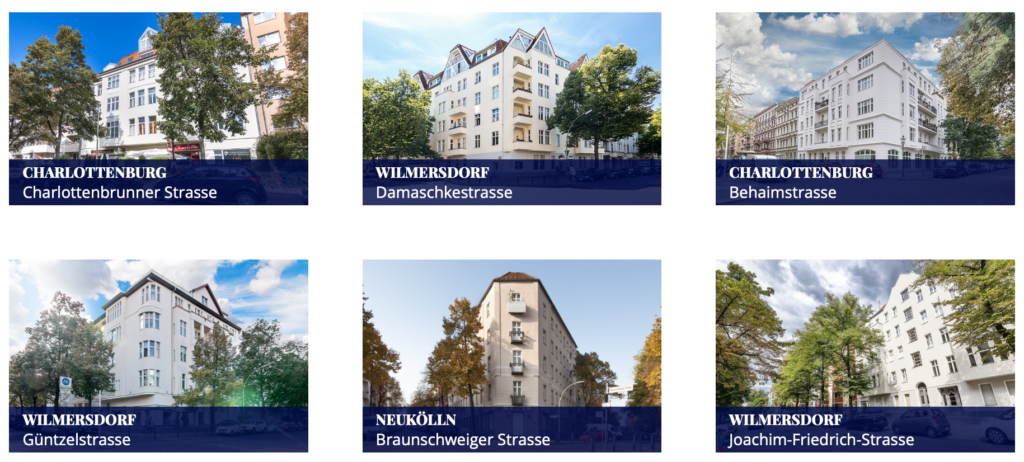

3. Real Estate Investments: Building Assets with Tangibility

The significance of a diversified investment portfolio cannot be stressed enough.

Venturing into Real Estate Investments can offer a constant income flow, both from rental returns and property value increases.

That said, real estate often requires significant capital from the outset. Hence, it’s crucial to undertake a comprehensive market analysis.

When selecting a location to purchase property, focus on areas with a robust and expanding economy, the consistent influx of new residents, a market that’s undervalued yet has growth potential, and high employment rates are all crucial factors that shouldn’t be overlooked.

Berlin is often cited as the city that offers the best value that ticks all the boxes. If you would like to learn more about Berlin, then click here.

DO NOT buy an off-plan property that guarantees a rental income!

Jurisdictions and Laws

Most countries that offer investors offshore accounts operate similarly to each other, although certain countries offer higher protection and easier access. Places like Switzerland, Cayman Islands, BVI, Hong Kong, Malaysia and Cyprus are often chosen for the favourable conditions that they offer.

With every country, you will need to complete a simple anti-money laundering test when transferring larger amounts of money.

Often, this task falls upon your advisor to complete a simple exercise to prove where the money originated.

Each country will have its own set of laws connected to the way it operates, so speak with someone knowledgeable to make sure you are choosing the right location.

Read this article here for a good insight into choosing the right offshore jurisdiction for your investment.

Asset Protection

Offshore wealth management provides robust protection against legal claims and lawsuits. You’re less vulnerable to frivolous lawsuits when your assets are offshore.

It is common for small businesses to set up all of their banking offshore when conducting business in multiple jurisdictions.

If you are a trading company that buys textiles from Vietnam or electronics from China and you sell these items in the West, you can form a company in an offshore location that acts as a go-between for your company finances.

This kind of separation is crucial for your protection as laws can change very quickly, and as a foreigner, you can be stung by a change of situation in the countries where you operate.

When the war between Russia and Ukraine started, Russia closed all foreign-owned companies, reciprocating what the West was doing to them. If you had all of your money tied up in your Russian company, then your business could have been in a potentially fatal situation that could have been easily avoided by using an offshore holding company.

Tax Efficiency

Offshore wealth management can offer tax advantages depending on the laws of your home and host countries.

Excluding America and a few other nations, most countries allow their citizens to work and earn money overseas without having to pay taxes back in their home country.

Often, there will be a double-taxation treaty set up between the country where you are from and the country where you live and work, but you need to check this first.

Take this as a case example: If you are a French person and you are working in China, or you are a Chinese person working in France, then you will be taxed in the country where you are working and earning, and you will have no income tax liability back in your home country, due to the double-taxation treaty.

Once you have received your income and have been taxed, then you are free to invest your money anywhere in the world, as you are now deemed to be “offshore”. If you choose not to do this and instead invest this money in China or France, you may be liable for tax on the gains from your investment as you are a resident or a national of one of these countries.

Furthermore, you will likely be exempt from tax-free or tax-deferred schemes that each of these governments offers their nationals/residents through government-sponsored investment plans.

By investing overseas into an offshore account, you can circumvent all of this potential tax liability and grow your money free from capital gains tax in a safe, neutral country in an “offshore investment”.

Investment Diversification & Currency Fluctuation

When investing offshore, investors can access global markets and diversify their investment portfolio, mitigating risks and boosting returns.

Now, you can invest and hold your money in different currencies. Your options may appear limitless, but despite what many people may tell you, the Dollar/Euro/Pound are still the world’s largest investment currencies for expats.

The US Dollar is also one of the most stable currencies in the world, and lots of other currencies still peg themselves to the it. Oil is also priced in dollars, so as long as this remains, the dollar will always have an intrinsic value.

Most investments around the world are priced in dollars, so it is common for people who live and work overseas to choose the dollar as their base currency.

Moving all of your assets into one currency can help mitigate against currency fluctuations rather than working in multiple currencies that constantly move against each other.

The US Dollar might not be the right option for everybody, but we always advise our clients to think globally and look more at the bigger picture.

Choosing the Right Offshore Wealth Management Firm

Your financial voyage can be smooth with the right crew. Choosing a reputable and experienced wealth management firm is crucial.

Now that your investment scope is more global-focused, the importance of having the right people around has never been more important.

Our advice at Hampton Bridge is always to keep things as simple as possible and to mainly invest in traditional assets. There might be an appeal to invest in new/alternative investments such as the ones stated in this article, but on the whole, we always advise our clients to invest in mutual funds or ETFs.

If you want to learn more about “Offshore wealth Management, then please read through our advice centre here and follow us for constant updates.

Here you will find lots of helpful articles about choosing the right investment company and the correct advisor, what pitfalls to avoid and how you can make the most of living your expat life by following a few simple rules.

Conclusion

Offshore wealth management is a strategic move to grow and safeguard wealth. It offers multiple benefits, but also requires careful navigation around potential risks and challenges. With the right guidance, the sea of offshore wealth management can lead you to financial success.

Please contact us today as we would be delighted to help you. on this journey.

Frequently Asked Questions (FAQs)

What is offshore wealth management?

Offshore wealth management is a strategy to manage and grow wealth using foreign financial institutions, investments, and legal structures.

Why do people use offshore wealth management?

People use offshore wealth management for reasons such as asset protection, tax efficiency, and investment diversification.

Are offshore accounts legal?

Yes, offshore accounts are legal, provided they are declared and taxes are paid as required by the law of the individual’s home country.

What are the risks associated with offshore wealth management?

Risks include regulatory compliance and reputational damage.

How to choose the right offshore wealth management firm?

Choosing a firm with a good reputation, proven expertise, and experience in managing offshore accounts is crucial.

Conclusion

Offshore wealth management is a strategic move to grow and safeguard wealth. It offers multiple benefits but requires careful navigation around potential risks and challenges. With guidance, the sea of offshore wealth management can lead you to financial success.

Please contact us today as we would be delighted to help you on this journey.